Are you planning a move to Canada? If so, one of your primary considerations is likely to be the cost of housing. This article examines Canadian house prices by city and the difference in provincial real estate costs.

There is massive variation in housing costs within Canada and individual provinces. As a result, your decision is not just about whether you should move to Canada but whereabouts within Canada you should settle.

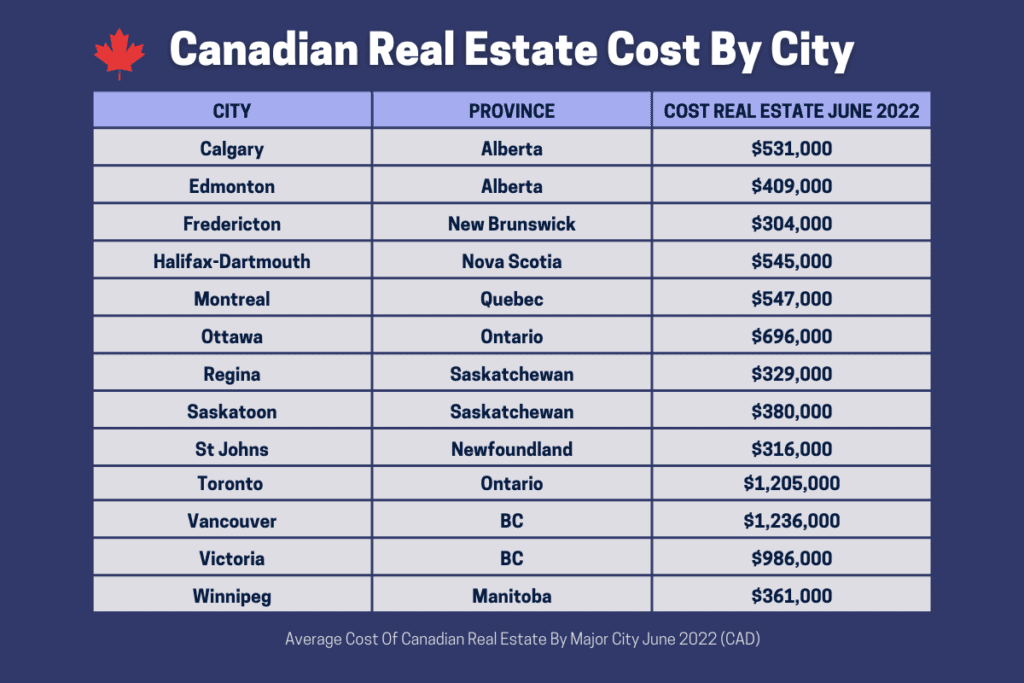

Canadian House Prices By City

Canada has some of the most expensive real estate in the world. For example, a 2022 study by Statista.com determined that Vancouver’s housing market was the 7th most expensive in the world.

Recent data from the Canadian Real Estate Association show that costs in Greater Toronto are currently only marginally lower than those in Vancouver. These two cities generally compete for the title of the most expensive city in Canada.

As you would expect, costs drop as you move away from these cities, and property prices in rural areas are often a fraction of those in the big cities. zola.ca is a valuable resource for researching property prices.

This website provides details of property listings in a particular city or town and average prices for different property types (e.g. detached properties vs townhouses vs condos).

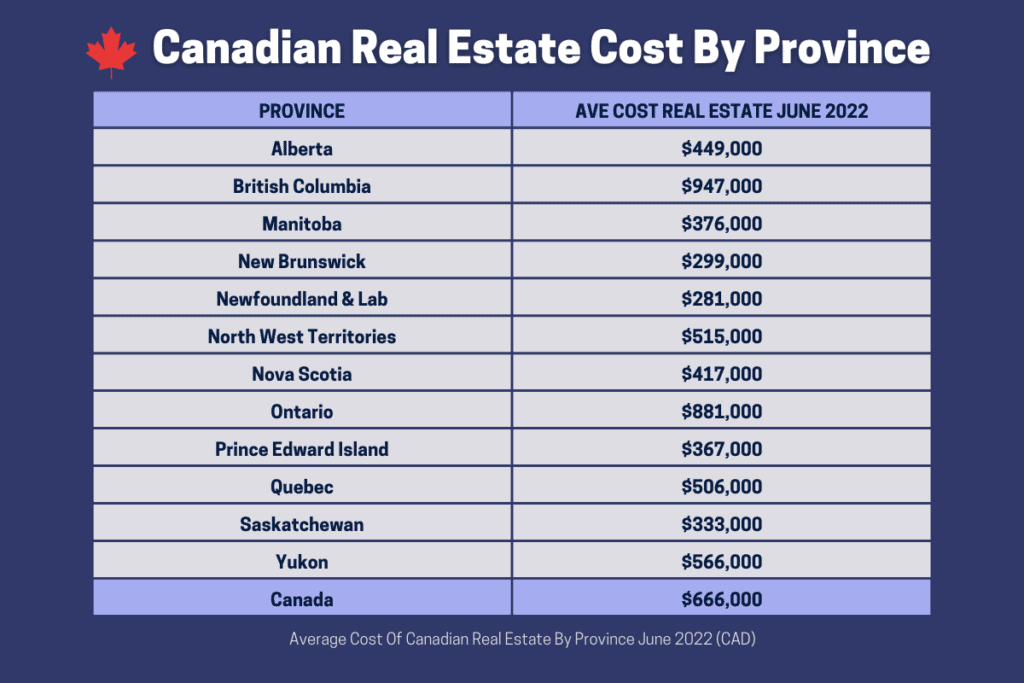

Canadian House Prices By Province

House prices in British Columbia and Ontario are significantly higher than in Canada’s other provinces and territories. However, this is partially due to costs in Vancouver and Toronto driving the averages up.

The maritime provinces have very affordable housing if you are looking for cheaper property. However, you may find that job opportunities are more limited in these smaller provinces.

The central prairie provinces of Saskatchewan and Manitoba are popular, with some immigrants attracted to the low cost of living. However, these provinces are less populated and have harsh winters, but if these aren’t an issue for you, your property will be excellent value for money.

Do I Need A Realtor To Buy A House In Canada?

You don’t need a realtor to buy a house in Canada, but I would advise it, especially if you are new. Two realtors will be involved in most property sales; one realtor will act for the buyer, and one will work for the seller.

The seller typically pays both realtors’ costs from the sale’s proceeds. Therefore, you don’t need to worry about this cost as a buyer.

However, if you buy from someone selling their home privately, you must be clear about who pays for your realtor’s costs.

As a buyer, we have found our realtors invaluable. A good buyers realtor will:

- Actively seeks suitable properties for you

- Organize and conduct viewings for you

- Provide information on neighbourhoods and homes

- Negotiate purchase price via the seller’s realtor

- Draw up a binding contract of purchase

- Carry out the title and other property searches

- Generally, help you avoid pitfalls and guide you through the buying process

The Hidden Costs Of Buying A Home In Canada

You will be aware that there are additional costs to buying a home in any country. However, some of the costs in Canada may not be obvious, especially to people from overseas. Your realtor can advise on the charges that will apply to you, but here are some things you may need to consider when budgeting.

- Property or land transfer tax (varies according to the geographical area)

- Provincial sales tax (on new builds)

- Regional/municipal sales tax (only applies to some regions)

- Home inspection fee (not mandatory but recommended)

- Lawyers fees

- Bank appraisal fees (relating to mortgage approval)

- Currency transfer and conversion costs (if moving from overseas)

- Realtor fees (if the property is being sold privately)

Which Province Should I Choose?

The other side of the equation regarding location is how much you can earn. Toronto is, of course, expensive, but the job opportunities there are excellent, and this attracts many immigrants to the city.

Also, you may be surprised just how much difference there is between provinces regarding certain costs. Before deciding on any region, you should research the following:

- Sales taxes (varies from 5% to 15%)

- Income taxes

- Property taxes

- Home Insurance

- Car insurance (is frighteningly high in some areas)

- Condominium & strata fees

FAQ – Canadian House Prices By City

Will I pay sales tax on a house in Canada?

If you buy a used owner-occupied house, you will likely be exempt from sales tax in Canada. However, if you buy a new build, it is likely to be subject to sales tax. If you meet certain conditions (e.g. the house must be your principal residence), you may be able to apply for a partial rebate. The tax rate will vary depending on the province you are buying in.

What is property transfer tax?

Property transfer tax is paid by buyers when they purchase a property. The amount varies according to province (and sometimes by municipality) but is generally a proportion of the sales price. As a result, the cost can be substantial for more expensive properties. Note that first-time buyers can often claim a rebate of this tax.

What is the minimum downpayment for a house in Canada?

Ultimately your mortgage provider will determine the down payment you need to make. However, the government of Canada has set minimum down payment amounts related to the property value. These range from 5% for less than $500,000 properties to 20% for more than $1 million.

Can a non-resident buy a house in Canada?

Anyone can buy a house in Canada; you do not need to be a citizen or hold any particular immigration status. However, in some provinces, you will probably be subject to a Non-Resident Speculation Tax, which can be a significant proportion of the purchase price. Also, your time spent in Canada will still be restricted to that allowed for non-residents.

How long does it take to buy a house in Canada?

The house-buying process in Canada typically takes between 30 and 60 days. This timescale assumes that you don’t have a property to sell or already have a buyer lined up for your existing property.

Hi Jill, I stumbled across your post and have the opposite interest: moving to the UK from Canada. Any tips you can impart? Thanks so much

Guy

Hello Guy, it’s difficult to know where to start! If you can choose your location, it is cheaper in the north of the country. The country is very crowded compared to Canada and traffic is generally heavy. The weather will feel colder than you expect due to the damp atmosphere. However, the English are very friendly and have a great sense of humour. I don’t know a lot about the immigration process for moving TO the UK, but happy to answer any specific questions you might have about living there.